Do You Issue A 1099 For Expense Reimbursements . assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. employee business expense reimbursements. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099.

from dxohusyzi.blob.core.windows.net

issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. employee business expense reimbursements.

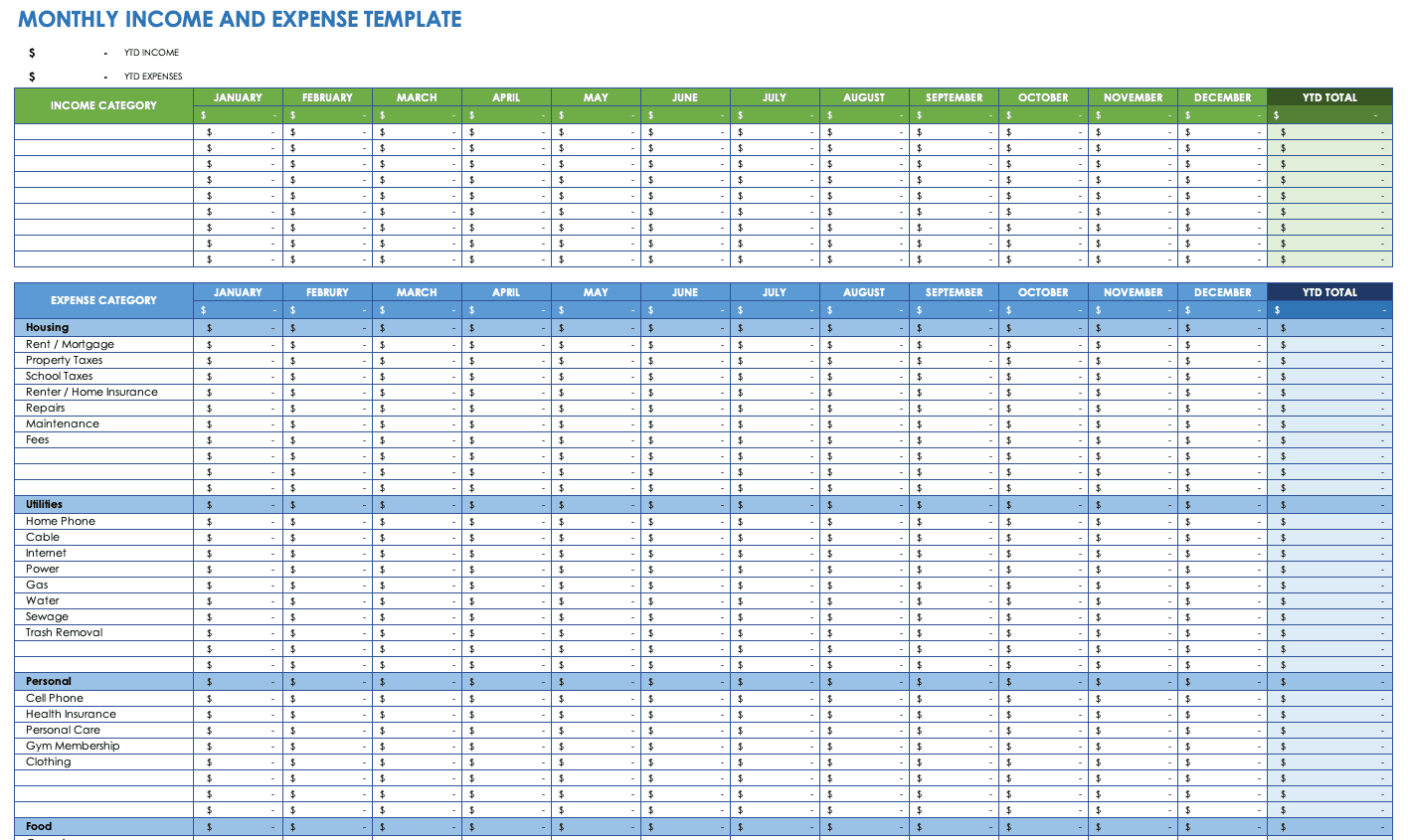

Excel Template For Small Business And Expenses at Darlene

Do You Issue A 1099 For Expense Reimbursements if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. employee business expense reimbursements. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the.

From www.form8949.com

Types of Data Files Supplied by Brokers Do You Issue A 1099 For Expense Reimbursements should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement. Do You Issue A 1099 For Expense Reimbursements.

From jjgals.blogspot.com

How To Report Reimbursed Expenses On 1099 Patricia Wheatley's Templates Do You Issue A 1099 For Expense Reimbursements issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the.. Do You Issue A 1099 For Expense Reimbursements.

From www.accountingprose.com

Do You Need to Issue a 1099 to your Vendors? Accountingprose Do You Issue A 1099 For Expense Reimbursements should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. employee business expense reimbursements. if you work for yourself and receive one or more 1099. Do You Issue A 1099 For Expense Reimbursements.

From www.mgtaxinc.com

Checklist — MG TAX INC Do You Issue A 1099 For Expense Reimbursements if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. employee business expense reimbursements. issuing a 1099 for expense reimbursements depends on the. Do You Issue A 1099 For Expense Reimbursements.

From mavink.com

1099 Flowchart Do You Issue A 1099 For Expense Reimbursements should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the.. Do You Issue A 1099 For Expense Reimbursements.

From printableformsfree.com

2023 Form 1099 R Printable Forms Free Online Do You Issue A 1099 For Expense Reimbursements employee business expense reimbursements. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. if you work for yourself and receive one or more 1099. Do You Issue A 1099 For Expense Reimbursements.

From dxohusyzi.blob.core.windows.net

Excel Template For Small Business And Expenses at Darlene Do You Issue A 1099 For Expense Reimbursements if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement. Do You Issue A 1099 For Expense Reimbursements.

From www.depauwtax.com

What is a 1099Misc Form? Financial Strategy Center Do You Issue A 1099 For Expense Reimbursements assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the. Do You Issue A 1099 For Expense Reimbursements.

From www.etsy.com

1099 Optavia Coach Expense Tracking Spreadsheet for Taxes Etsy Do You Issue A 1099 For Expense Reimbursements employee business expense reimbursements. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. assuming the client reimburses valid business expenses, the contractor will not report the. Do You Issue A 1099 For Expense Reimbursements.

From tipseri.com

How much does it cost to buy a plane ticket to Australia? Tipseri Do You Issue A 1099 For Expense Reimbursements assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. employee business expense reimbursements. issuing a 1099 for expense reimbursements depends on. Do You Issue A 1099 For Expense Reimbursements.

From www.wellybox.com

How to Track 1099 Expenses as an Independent Contractor? WellyBox Do You Issue A 1099 For Expense Reimbursements assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. if you work for yourself and receive one or more 1099 forms, you may be able. Do You Issue A 1099 For Expense Reimbursements.

From robinhood.com

How to read your 1099 Robinhood Do You Issue A 1099 For Expense Reimbursements should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. employee business expense reimbursements. issuing a 1099 for expense reimbursements depends on the type of. Do You Issue A 1099 For Expense Reimbursements.

From www.hellobonsai.com

Free 1099 Template Excel (With StepByStep Instructions!) Do You Issue A 1099 For Expense Reimbursements if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. employee business expense reimbursements. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. assuming the client reimburses valid business expenses, the contractor. Do You Issue A 1099 For Expense Reimbursements.

From fitsmallbusiness.com

IRS Form 1099 Reporting for Small Business Owners Do You Issue A 1099 For Expense Reimbursements issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the.. Do You Issue A 1099 For Expense Reimbursements.

From falconexpenses.com

What is Form 1099NEC for Nonemployee Compensation Do You Issue A 1099 For Expense Reimbursements issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the.. Do You Issue A 1099 For Expense Reimbursements.

From www.mgtaxinc.com

Checklist — MG TAX INC Do You Issue A 1099 For Expense Reimbursements should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. employee business expense reimbursements. if you work for yourself and receive one or more 1099 forms, you may be able to claim reimbursed expenses on a 1099. issuing a 1099 for expense reimbursements depends on the. Do You Issue A 1099 For Expense Reimbursements.

From attorney-faq.com

When Do You Issue A 1099 To An Attorney Do You Issue A 1099 For Expense Reimbursements should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. employee business expense reimbursements. assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income,. Do You Issue A 1099 For Expense Reimbursements.

From www.signnow.com

Do I Need to File a 1099b If the Balance is Zero 20182024 Form Fill Do You Issue A 1099 For Expense Reimbursements assuming the client reimburses valid business expenses, the contractor will not report the reimbursement as income, nor will he deduct the. issuing a 1099 for expense reimbursements depends on the type of reimbursement, the amount of the. should i record each transaction in the appropriate expense category and issue a 1099 for the whole amount for the.. Do You Issue A 1099 For Expense Reimbursements.